Ramadan in Indonesia significantly alters the consumer landscape, presenting a complex tapestry of behaviors influenced by a blend of religious, economic, and social factors. This chapter offers a detailed exploration of the nuanced consumer behaviors during this sacred month, providing insights into how economic conditions, political climate and evolving consumer trends influence spending habits.

Table of Contents

Demand Increase in Retail Brands During Ramadan

The onset of Ramadan brings a distinct shift in consumer spending patterns in Indonesia. There is an increased expenditure on food and beverages due to the preparation of special meals for Iftar and Suhoor, the pre-dawn meal. Supermarkets and local markets often witness a surge in footfall, with shoppers seeking fresh ingredients and special Ramadan treats.

Clothing and fashion also see a spike in sales as people shop for new outfits for Eid al-Fitr. This period is crucial for the fashion industry, with many launching special Ramadan collections. Additionally, there is an upsurge in spending on home furnishings and decorations to create a festive ambience.

Google noted that e-commerce web traffic spiked to almost 152% during the Ramadan period. These are the categories that Indonesian consumers plan to spend during Ramadan 2023:

Influence of Economic Conditions and Political Climate

Economic conditions play a significant role in shaping consumer behaviours during Ramadan. Inflation rates, disposable income levels, and overall economic stability can significantly impact how much consumers are willing to spend. Political climate, especially in a post-election scenario, can also influence consumer confidence and spending behaviours. Marketers need to be cognizant of these factors and adjust their strategies accordingly.

Shift Towards Intentional and Ethical Spending

A growing trend in Indonesia, particularly during Ramadan, is the shift towards more intentional and ethical spending. Consumers are becoming increasingly conscious of where and how they spend their money. There is a growing preference for products that are ethically sourced and produced, aligning with the Islamic principles of fairness and responsibility.

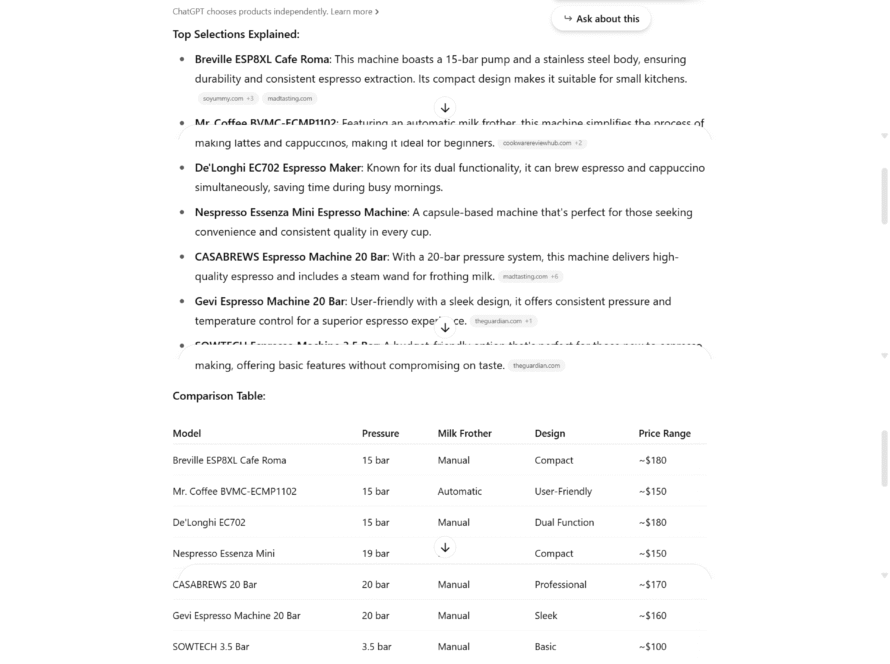

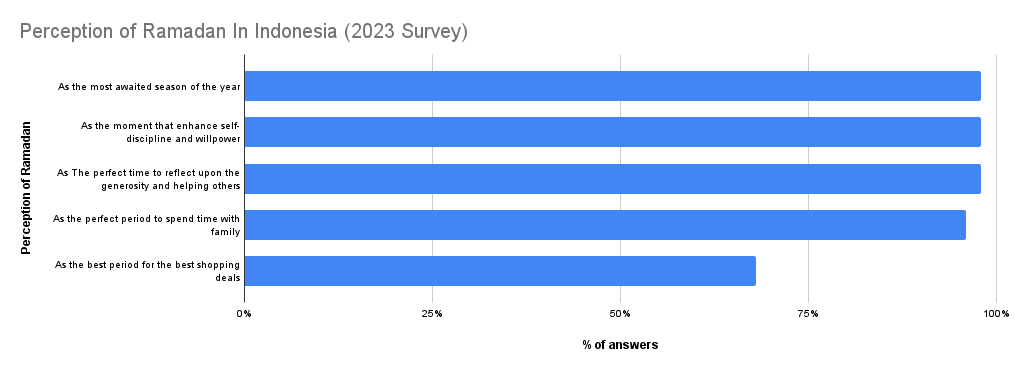

Interestingly enough, research shows Indonesian sentiments towards Ramadan, and here are the results:

This trend is particularly evident in the food sector, where there is an increasing demand for halal-certified products and those that support local farmers and communities. Similarly, in the fashion industry, there is a growing interest in sustainable and ethically produced clothing.

Looking at the mentioned chart of THR allowance allocation, 82% of the sample surveyed decided to spend their THR on clothing, while 75% on food & beverages. Placing them on the top shopped categories that happened during the Ramadan period.

Digital Influence on Ramadan Shopping

The digital revolution in Indonesia has had a significant impact on Ramadan shopping habits. E-commerce platforms see a spike in activity during this period, offering convenience and a wide range of options for consumers. Online shopping allows consumers to avoid crowded markets, a particularly appealing option for those balancing busy schedules with fasting and religious obligations.

Social media also plays a pivotal role in influencing consumer decisions. Influencers and community groups often share recommendations and reviews, impacting where and how people shop during Ramadan. Digital marketing campaigns that leverage these platforms effectively can significantly influence consumer behaviour.

Understanding the Shift in Consumer Priorities

During Ramadan, there is a noticeable shift in consumer priorities. While there is an emphasis on purchasing goods for personal and family use, there is also a heightened focus on charity and giving. Many consumers allocate a portion of their spending towards charitable causes, aligning with the spirit of Zakat.

Understanding these shifts in priorities is crucial for marketers. Campaigns and strategies that acknowledge and support these priorities, such as initiatives that contribute to charitable causes or offer value-driven products, are likely to resonate more deeply with the Ramadan consumer.

Let’s take a deeper look at how the shift took place in Indonesia. COVID plays a big role in changing consumer behaviours. Saatchi did a research focusing on how Indonesians feel the urgency to “strengthen” their faith after the pandemic.

While post-COVID enabled consumers to rediscover their shopping habits, the circulating news and experience moved consumers to start caring about others, especially those in pain.

There are 2x increase in media consumption surrounding the topics of “digital donation” and a 4x increase in interest towards “food parcels & deliveries”. Moreover, during Ramadan a large percentage of customers stated that they have engaged in charity, resulting in IDR13 billion alone for Zakat collected during the Ramadan period.

Revolutionizing Ramadan Retail with Live Shopping and E-commerce

The Emergence of E-commerce and Live Shopping During Ramadan

In the evolving retail landscape of Indonesia during Ramadan, e-commerce and live shopping have revolutionised how consumers engage with brands and make purchases. This chapter delves into the growing trends in Ramadan e-commerce, the integration of social media with shopping platforms, and the impact of global e-commerce giants like Amazon, alongside owned e-commerce platforms and marketplace shopping through WhatsApp and Instagram.

The Surge of E-commerce Platforms: Shopee and Tokopedia

Shopee and Tokopedia, as leading e-commerce platforms in Indonesia, have become central to the Ramadan shopping experience. These platforms cater to the unique needs of Ramadan shoppers, offering a wide range of products from food and fashion to home decor and religious items. The convenience, variety, and competitive pricing these platforms offer make them highly attractive to consumers during the busy Ramadan period.

Special Ramadan promotions, flash sales, and exclusive deals further drive traffic and sales on these platforms. By leveraging data analytics, Shopee and Tokopedia can offer personalized shopping experiences, recommending products based on consumer preferences and past purchases.

Live Shopping: A Game-Changer in Ramadan Retail

Live shopping, particularly on platforms like TikTok, has emerged as a game-changer in Ramadan retail. It combines the immediacy of online shopping with the interactivity of live video, creating an engaging and dynamic shopping experience. Brands can showcase their products in real-time, answer questions, and offer exclusive Ramadan deals, making it a powerful tool for driving sales and customer engagement.

Influencers and celebrities often host these live shopping sessions, adding their charisma and trust factor to the shopping experience. This format is especially popular for categories like fashion and beauty, where seeing products in use can significantly influence purchasing decisions.

Here’s a quick look at TikTok business insights during Ramadan:

| TikTok Media Consumption | Notable Insights in 2022 |

| Video views insights | An increase of around 44% in video views in Ramadan 2022 as compared to 2021 |

| Content Creation | An increase of 28% more videos created during Ramadan 2022 |

| Engagement Rate | An increase of 18% in engagement rate vs the previous year |

| Product Discoverability | 47% of TikTok users find new products/services related to Ramadan on TikTok |

Combining this trend of media consumption with an ever-increasing shopping trend, resulted in excellent live shopping numbers.

| TikTok Shopping Experience | Notable Insights in 2022 |

| Live Stream Users | 54% of TikTok users engaged in Ramadan live streams |

| Basket Size | 67% of TikTok users spent more than usual for Ramadan 2023 |

| Product Sales | TikTok users are 2x more likely to buy Ramadan-related product bundles |

Global E-commerce Platforms: The Influence of Amazon

Global e-commerce platforms like Amazon, though not as dominant in Indonesia, still play a role in Ramadan retail, especially for consumers looking for international products or brands not available locally. For Indonesian consumers with access to these platforms, Amazon offers an alternative for purchasing unique or hard-to-find Ramadan items.

Brands that operate on a global scale can leverage Amazon to reach the Indonesian diaspora and those seeking international products during Ramadan. This requires an understanding of the global e-commerce ecosystem and how to effectively navigate logistics, customs, and international marketing.

Owned E-commerce: Direct Consumer Engagement

Apart from marketplace giants, owned e-commerce platforms offer brands a direct line to consumers. These platforms allow brands to control the customer experience from start to finish, offering a more branded and personalized shopping journey. During Ramadan, brands can customize their e-commerce sites with Ramadan themes, offer special deals, and create content that resonates with the Ramadan spirit.

Owned e-commerce also provides valuable data insights, enabling brands to understand consumer behaviour better and tailor their offerings accordingly. This can lead to more effective targeting and personalisation, enhancing customer satisfaction and loyalty.

Marketplace Shopping via WhatsApp and Instagram

With the rise of social commerce, platforms like WhatsApp and Instagram have become viable channels for marketplace shopping. Brands can use these platforms for one-on-one engagement, offering personalized recommendations and exclusive Ramadan deals. WhatsApp, with its widespread usage in Indonesia, is particularly effective for direct communication and customer service.

Instagram, with its visual appeal, is ideal for showcasing products. Brands can use Instagram Stories, Posts, and the Shopping feature to create a seamless shopping experience. During Ramadan, these platforms can be leveraged for time-limited offers, flash sales, or showcasing special Eid collections.

Integrating Omnichannel Strategies

An effective Ramadan e-commerce strategy involves integrating these various channels into a cohesive omnichannel approach. This could mean syncing the product offerings and promotions across Shopee, Tokopedia, owned e-commerce platforms, and social commerce channels. Ensuring a consistent brand message and seamless customer experience across these platforms is key to maximizing reach and engagement during Ramadan.

The rise of e-commerce and live shopping has transformed the Ramadan retail experience in Indonesia. Platforms like Shopee, Tokopedia, and TikTok, along with global players like Amazon, and owned e-commerce sites, offer diverse avenues for brands to connect with consumers. Integrating these platforms into an omnichannel strategy, and leveraging the unique strengths of each can lead to a successful and engaging Ramadan retail experience.

Platforms like Shopee and Tokopedia have become central to the Ramadan retail experience, enabling consumers to fulfil their festive needs with convenience and efficiency. Live shopping events on platforms like TikTok and Instagram have not only added dynamism to the retail landscape but have also carved out a new domain for interactive consumer engagement. The participation of influencers and KOLs during this period has become a game-changer, with their ability to sway consumer choices and amplify the reach of marketing campaigns.

The impact of global e-commerce platforms like Amazon, albeit less dominant, offers insights into the reach and aspirations of the Indonesian consumer, who occasionally looks beyond local offerings for Ramadan essentials. Meanwhile, owned e-commerce platforms and marketplace shopping via WhatsApp and Instagram are a testament to the innovative and adaptive strategies employed by brands to meet consumers where they are.